Sunday’s Arkansas Democrat Gazette featured a column by Bradley R. Gitz titled “Obama’s economics” . The article is really an exercise in “how many mistakes can you make in so many paragraphs”. The column contains so many demonstrable factual errors, even this cynic is mildly surprised by the ADG’s lack of editorial oversight. How many times can the ADG opinion editors afford to be caught red-handedly lying without causing embarrassment?

Gitz is a regular ADG columnist whose right-wing extremist views are well known. I won’t waste time examining these views. I continue to believe that the Gitzes of the world are entitled to their opinions but not to making up their own facts. We’ll consider his factual statements only. How many mistakes can you catch in just the following paragraph?

“As Milton Wolf notes in a perceptive column for the Washington Times, when Ronald Reagan assumed the presidency in 1981 the nation was experiencing an especially severe recession featuring double-digit inflation and double-digit unemployment. Reagan’s response was to implement a recovery program consisting of tax, spending and regulatory cuts coupled with a strong dollar monetary policy. Recovery came quickly enough for him to win 49 states in 1984, by which time the country had also embarked upon what would become two decades of virtually uninterrupted economic growth and wealth creation.

Barack Obama came to office facing comparably difficult economic circumstances.”

Here are the main factual inaccuracies in that single paragraph (scroll down for charts on unemployment, debt and deficits):

1. In 1980/81, as Reagan took over the presidency from Jimmy Carter, the nation did not experience a severe recession and unemployment was not in the double digits.

2. In fact, a severe recession started after Reagan had taken office. “The early 1980s recession was a severe recession in the United States which began in July 1981 and ended in November 1982. The primary cause of the recession was a contractionary monetary policy established by the Federal Reserve System to control high inflation” (in other words, what caused the recession was precisely the strong dollar monetary policy that Gitz praises.) (wikipedia)

3. Unemployment had been 6% in 1978 and 1979 and was below 8% in 1980 (Carter presidency). It shot up to almost 10% during the early Reagan years (1982 and 1983), which is higher than it has been at the height of the current crisis. It started declining in 1984.

4. The “two decades of virtually uninterrupted economic growth and wealth creation” were in fact interrupted by the 1981/82 recession (Reagan), the 1990/91 recession (George H. W. Bush), and the 2001 recession (George W. Bush), to be followed by the Great Recession that started in 2007 (again under George W. Bush’s presidency). Only the Clinton-years from 1993 to 2000 were recession-free.

UPDATE: Paul Krugman weighs in with a chart showing GDP long term growth rates. Reaganite growth rates were anything but miraculous. See also Richard S. Grossman debunking similar claims made in the Wall Street Journal.

5. Reagan did not cut federal spending, at least not in the aggregate. The federal budget continued increasing under his watch, mainly due to massive increases in the military budget. In total, Reagan presided over a 69% spending increase. Federal spending as a share of GDP reached an unprecedented 23.5% in 1983.

6. Reagan did enact tax cuts but also tax increases. He started with a major tax cut in 1981 (The Economic Recovery Tax Act) but this was followed by a series of no less than ten (10) tax hikes, beginning in 1982 (during the recession) with the Tax Equity and Fiscal Responsibility Act, which collectively took half of the 1981 tax cut back (source).

7. Reagan never managed to balance the budget. His tax cuts and military spending were deficit financed. All of Reagan’s deficits were higher than all of Carter’s and all but one of Clinton’s. On average, Reagan’s deficits were 4.3% of GDP, compared to Carter’s 2.4% and Clinton’s 0.1%. The federal deficit reached an unprecedented 6% of GDP in 1983. In the words of Dick Cheney, Reagan “proved deficits don’t matter”.

8. In consequence, the federal debt almost tripled under Reagan’s watch, from about $1 trillion to $2.85 trillion (not adjusted for inflation).

9. Obama came to office inheriting from his predecessor the worst recession since the 1930s, triggered by a global financial crisis worse than anything seen in 80 years. Recall that the recession officially lasted from late 2007 to mid 2009, while Obama took office in January 2009. Reagan did not face a recession at all, let alone a crisis comparable to the Great Recession, when he took office in 1981. In fact, the main difficulty he faced was high inflation, which he brought under control at the price of a recession. Obama, in contrast, faced deflation. Does Gitz even know the difference?

In other words, you can’t possibly go wrong when you rely on Professor Bradley R. Gitz (PhD University of Illinois, “William Jefferson Clinton Professor of International Politics” at Lyon College), as long as you take the exact opposite of his claims to be true. Let’s point out the obvious. If any of us regular folks who actually work for a living, instead of being employed by a right-wing propaganda machine, managed to make so many mistakes in so short a time, we would be fired in an instant. Is there any kind of accountability at the Arkansas Democrat Gazette? Nope. None at all.

Update: Gitz’s Bankruptcy filing

***************************************

Charts

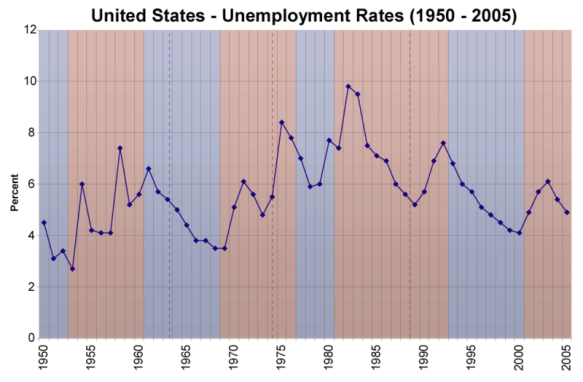

Unemployment Rates (for monthly rates, check the BLS)

The chart indicates Republican vs. Democratic presidencies by red/blue shading. Try looking for “double digit unemployment” during the Carter years (1977-1980). You’ll actually find it in 1982/83.

Federal Receipts, Outlays, and Deficits

Try looking for Reagan’s “spending cuts” – the orange line goes steadily up. Recessions are indicated by shading. Notice that only the Clinton years were uninterrupted by any recessions.

UPDATE: Federal Spending as % of GDP

Due to military spending, the federal government was bigger under Reagan than under both Carter and Clinton. More precisely, the average of federal spending as share of GDP was 22.3% for Reagan compared to 21.2% for Carter, 21.9% for Bush I, and 19.4% for Clinton.

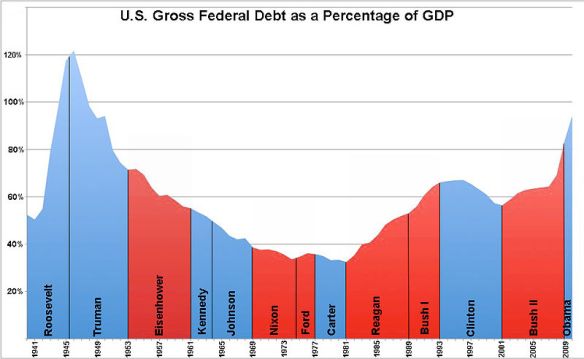

Gross Federal Debt

How did Reagan (as well as both Bushes) pay for tax cuts? Easy – by raising the national debt.